Our merger and acquisition integration methodology centers around four fundamental principles ensuring that each is addressed throughout the integration.

Merger & Acquisition Services, Inc. is a specialist advisory and financial services firm specifically to participants within the insurance industry.

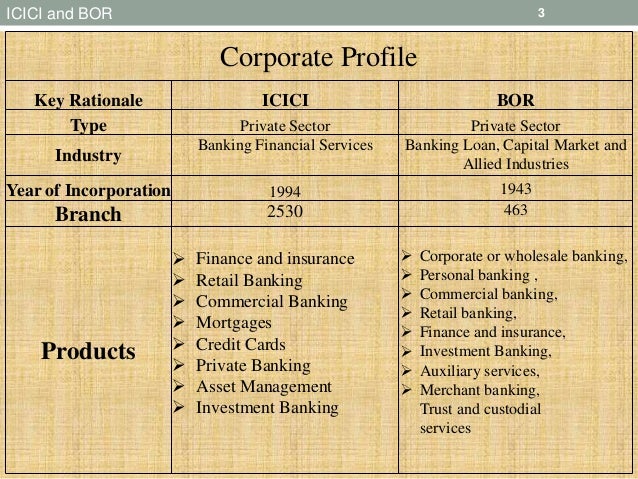

Read about the legal and practical differences between a corporate merger and corporate acquisition, two terms often used as synonyms today.

MERGER AND ACQUISITION CHECKLIST. In the final analysis, Terminated Employees — As a result of a merger or acquisition,

Dec 19, 2014 · Read a summary of the most significant legal and business due diligence activities connected with a typical M&A transaction. By planning these activities

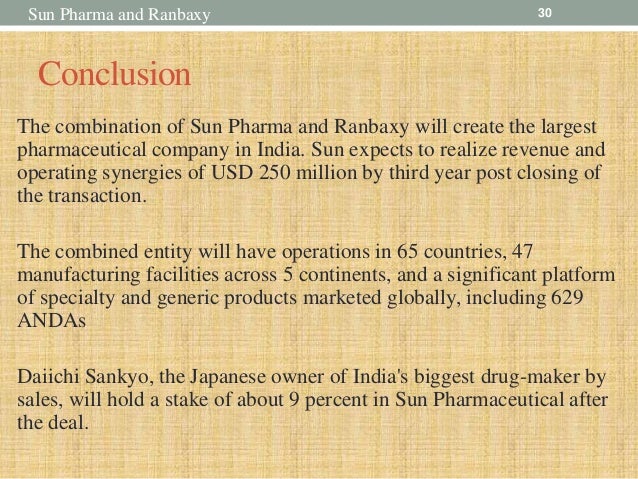

The benefits of mergers and acquisitions (M&A) include, among others: Short-distance transportation also involved more personnel hours (thus incurring higher labor

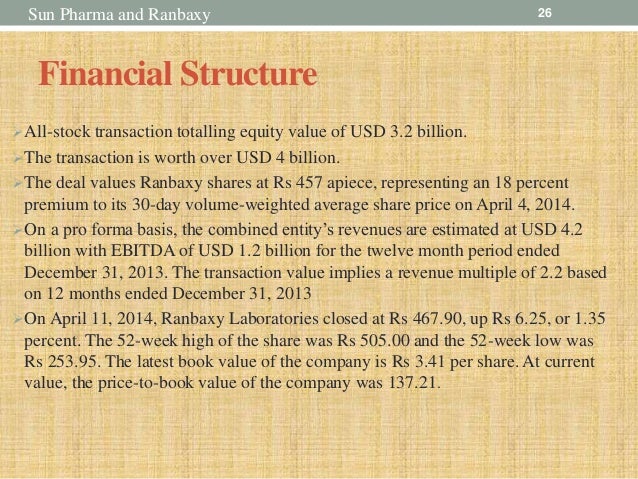

An acquisition or takeover is the purchase of one business or company by another company or other business entity. Specific acquisition targets can be identified

Acquisition | Merger Current Affairs and News for the years 2014 and 2015 available at JagranJosh.Com.

Shares of CA Inc. (CA) jumped over 16% in yesterday’s after-hours trade, following Bloomberg’s reports, citing anonymous sources, that the company is considering a

International Journal of Research in Management ISSN 2249-5908 Issue2, Vol. 2 (March-2012)